A Self Managed Super Fund (SMSF) is one of the most potent retirement vehicles in the civilised world.

One could mount an argument that there is no other government legislated vehicle in a first world country that has the sheer dexterity and horsepower of an SMSF.

A Self Managed Super Fund has a plethora of investment options.

An SMSF can hold the following investments as long as the investment is for the purposes of the members on retirement and the Trust Deed allows:

- The assets cannot give you an immediate benefit...

For Example:

If you have a holiday house, neither you nor relatives can use it.

If you have a boat, neither you nor related parties can sail with it. You can however lease it to non- related parties at market rates.

If you have wine, neither you nor related parties can drink it. If you have cigars, neither you nor related parties can smoke them.

Wine owned by your SMSF cannot be drunk.

If you have a piece of art you cannot hang it up in your home...It can however be leased to an art gallery that is paying market rate for displaying the art, or it goes into a safe or a cupboard.

If you have jewelery you cannot wear it! It has to go into a safe, or you could lease it to a non related party at market rates.

Do you get the picture?

The Investments shown below cannot give you an immediate benefit to you or a related party, outside benefiting your retirement.

This a list of some SMSF investments That Your Trust Deed Can Allow:

Jewellery

Pens

Watches

Jewels

Pianos

Coins

Cattle

Cigars

Art

Yachts

Race Horses

Vintage Cars

Gold

Residential Property

Commercial Property

Farms

Fish Farms

Stamps

Wine Vineyards

The list goes on and on!

If at this point you are questioning why my SMSF would buy a boat that I am not allowed to sail?

An SMSF is not about gaining benefit now - they are about gaining benefits in retirement.

There are stringent rules surrounding SMSF.

If you brought a boat and sailed it, your fund would be deemed non-complying and the fund could be fined close to half its value.

You may also receive a personal fine, and you could be disqualified from the fund.

What do Diamonds, Cigars, Wine and Art have in common?

Diamonds don't pay dividends! Neither do any of the others!

Just because you can buy Diamonds, Cigars,Wine, Art, Stamps or any of the other random investments does not mean you should!

Be careful!

This is your retirement savings account.

Remember you are going to need income in retirement?

The only way to get income from a cigar is to sell the cigars - cigars are not an asset you can lease!

An SMSF is an investment vehicle that gives you enough rope to hang yourself.

Things can go very, very wrong when investing in alternative assets.

Please call us before committing to any weird and wonderful alternative assets!

We need to not confuse 'things' we want to collect with 'assets' that will provide for income in our retirement.

Being A Trustee of an SMSF is like being a parent: You don't need any qualifications and you can really mess things up!

SMSF's Have Lots & Lots Of Rules!

The first rule is the SMSF Sole Purpose Test -

Essentially, you need to run the SMSF for the purpose of funding members on retirement.

Anyone related to the SMSF must not use the fund's assets.

If the SMSF investment were to give you immediate benefit, you should skip that investment!

SMSF's are restricted when investing with related parties like members or members relatives.

However, these restrictions do not apply to a purchase where an asset is 'Business real property'.

What is Business Real Property?

Examples of business real property include shops, offices, factories or warehouses

Does it have to be used entirely for a Business?

Usually yes, but some minor non-business use may be acceptable.

If a diary farm has a small house on the land, the main use of the land is for the business of farming; therefore, the private residence in this case is considered incidental.

Every business is different and how property is used will determine if it is business real property or not.

You should speak to us before purchasing a property.

What do I need to know when I buy an

Investment Property In Super?

Bull & Bear Financial Strategies are SMSF Professionals and we can work with both you and the bank to put the right structure in place for you and your family.

Do you understand why a Corporate Trustee can be better then an individual Trustee?

You Can't Afford To Get This Wrong!

Buy Property Through Super The Right Way!

With an individual trustee structure, when members leave or die, or a new member is added, the trustee has to correct the ownership of the investments.

If the fund has property or shares, this can take a considerable amount of time to change the ownership as well as incur greater costs. The process can also incur Stamp Duty and Capital Gains Tax.

With a Corporate Trustee, the assets are held in the company name making the transfer of ownership an easier process and Stamp Duty and Capital Gains Tax will not be incurred.

With an Individual Trustee, there must either be a Corporate Trustee with the member acting as the director of the corporate entity or another person must be the supplementary trustee. As can be imagined, this could be an inconveiance.

If you have a corporate Trustee then one person can be the Member and Director. No need to find a second person!

If the ATO believes that an SMSF has become non-compliant, in an individual trustee set-up, each trustee can be fined $10,200 each, totaling $40,800 to the one SMSF.

However, where an SMSF had a Corporate Trustee with 4 Directors being the individual members, the maximum fine to the Corporate Trustee is $10,200.

On this consideration alone, there is a benefit to establishing a Corporate Trustee.

Whats A Bare Trust?

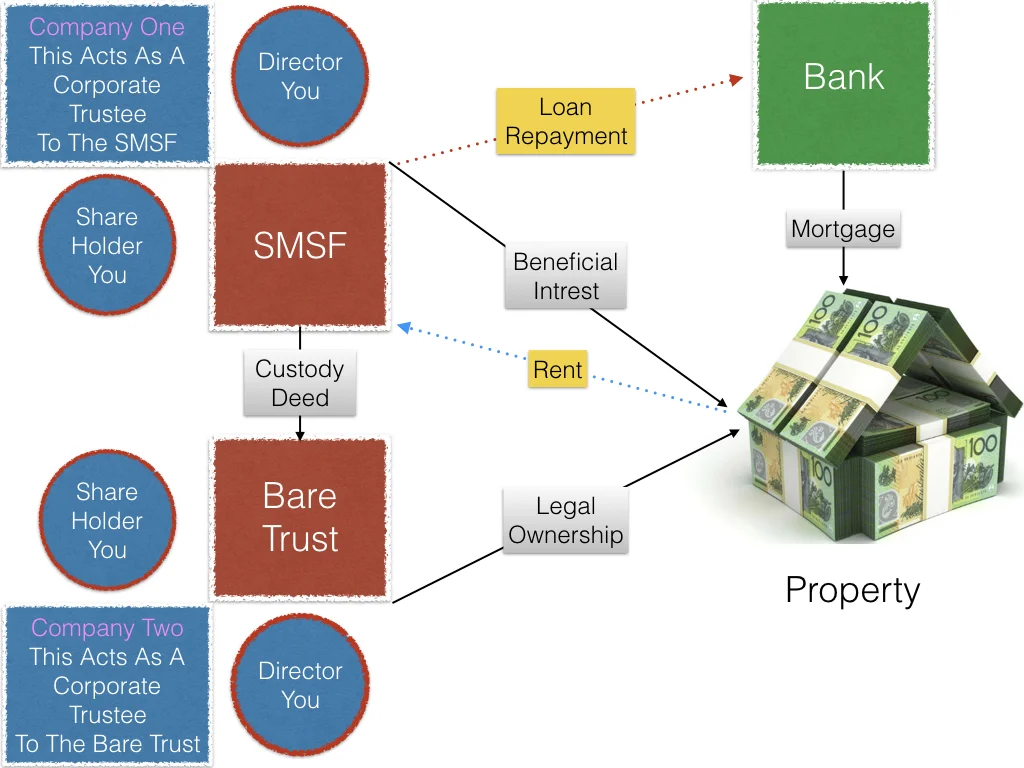

You will need a Bare Trust and a Corporate Trustee if you want to borrow in the Superannuation environment.

What is a Bare Trust?

The Bare Trust isolates the property acquired through borrowing from other assets held in the SMSF.

This may be beneficial if someone takes legal action against the SMSF.

Having an Individual Trustee behind the Bare Trust may not be a prudent strategy as an Individual Trustee can die, whereas a Corporate Trustee does not die because a company is an indefinitely continuing entity. In this instance, asset allocation can be replaced without affecting major change in ownership of the property within the bare trust.

Issues involved if an Individual Trustee of a Bare Trust dies:

- A new Trustee will need to be appointed

- Probate will need to be attended to

- Transfer of title to the new trustee will need to occur

- The Office of State Revenue will need to be notified and registration of transfer will need to occur.

If the the Bare Trust has a Corporate Trustee then it is much easier to transfer ownership if an individual dies or leaves the fund or becomes bankrupt.

Banks insist loans made to acquire property for a SMSF be held within a Bare Trust, with the SMSF being the beneficiary of the trust.

When the loan is repaid in full, the legal ownership of the investment property reverts to the trustees of the SMSF.

The trustees of the SMSF cannot be the same as the trustee of the Bare Trust.

It is for this reason that you need two corporate trustees: One behind the SMSF and the other behind the Bare Trust.

Mistakes When Buying WITH A SMSF

Individuals buy property in there own names or the name of the SMSF. The Bare Trustee must sign the contract and purchase the property.

People often confuse buying the property in the name of the Trustee of the SMSF rather than the Trustee of the Bare Trust. Big mistake!

The Bare Trust is only good for the purchase of a single asset.

People buy two properties in the bare trust! Another big mistake!

Believe it or not, people also buy from related parties! This is wrong!

People buy a house and land package! Another big no, no!

The diagram below illustrates the SMSF and the Bare Trust with the two separate corporate Trustees.

We acknowledge how confusing the diagram below looks to the untrained eye.

It is complicated.

Call us on 0450 077 442 and one of our team of SMSF Experts will explain this diagram to you.

Begin your journey to financial freedom by taking action now!

Calling us on 0450 077 442 or fill out the form below for a free consultation with one of our Financial Planners.